Technology Acquisition Options

By: Ciopages Staff Writer

Updated on: Feb 25, 2023

Let’s explore technology acquisition options for non-technology companies, which, however, are reliant on technology for transactions, operations, and functional enablement.

Today, as the saying goes, every company is a technology company. And many non-technology companies employ more technologists than even traditional technology firms.

For example, JP Morgan Chase, which is a giant financial institution, employs more than 50,000 technologists and spends more than $11 billion on technology development. Imagine the sheer scale of the budget and the number of employees.

Walmart, the retail behemoth, employs more than 10,000 technologists in the U.S. alone.

In comparison, SalesForce.com employs 49,000 overall employees, not all technologists. ServiceNow, the I.T. management software company, employs 11,000. And, Slack, the red hot startup employs only 1650 people.

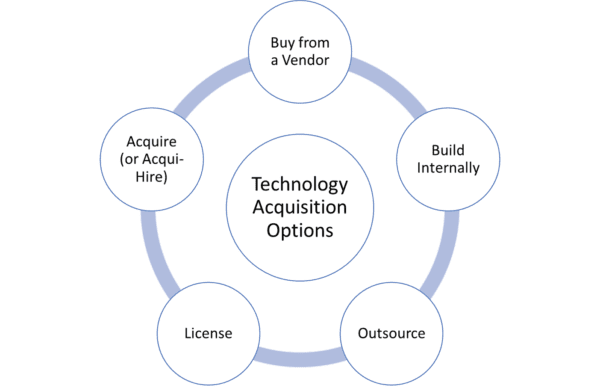

Now that it is evident that technology is a critical capability let’s examine what are the technology acquisition options and the best way to evaluate the buy, build, acquire, license, or outsource decisions.

Technology Acquisition Options and Alternatives:

One can categorize large companies into either a “buy shop” or a “build shop.” In general, these are cultural legacies established over the years. Several years ago, it may have been the right decision to build when there are no viable commercial options. But as years go on, the I.T. departments become highly vested in continuing the build patterns for no rationale other than “we have always done it this way.”

One can categorize large companies into either a “buy shop” or a “build shop.” In general, these are cultural legacies established over the years. Several years ago, it may have been the right decision to build when there are no viable commercial options. But as years go on, the I.T. departments become highly vested in continuing the build patterns for no rationale other than “we have always done it this way.”

Technology Acquisition Option 1 – Build Internally:

Leaving the cultural norms and I.T. legacies aside, let’s examine when would be a good time for companies to build technology internally?

- When a particular field is nascent, and the vendor landscape is not robust, and the feature set is rudimentary, it may necessitate a “Build internally” decision.

- When a specific capability is mission-critical and offers a tremendous competitive advantage, companies often choose to build the technology internally.

- Of course, there are times the cost considerations, in cases where they are favorable to the enterprise, will drive the build decision. (The cost is typically not advantageous to individual companies to build technologies that a vendor can amortize over several clients, but there are always those exceptions. For example, a company may have a specific group of developers, and other talents in an inexpensive overseas development center and hence could build it on the cheap.

When Build Technology Internally is a Bad Idea?

- The technology executives want to expand their empires and perpetuate the “build here” philosophy at all costs.

- They are spending large amounts of money on a technology capability that is a commodity and does not offer any competitive differentiation or marketplace advantages.

- They are building new technology using legacy programming on an antiquated tech stack.

While each sector and the company specifics may dictate the details, the general ratio of internal technology development spans about 30-35% of capabilities and 20-30% of the overall I.T. spend.

Technology Acquisition Option 2 – Buy from a Vendor

Thanks to the cloud, companies are relying on vendor software more than ever before. The B2B SAAS market, expected to be about the U.S. $220 billion, led by SalesForce.com and Workday, among others, have heralded a new way of licensing and subscribing to software that is available anywhere, any time and to anyone – all through a browser.

In addition to the advent of the cloud revolutionizing and revitalizing the software market, thanks to trends such as digital transformation and the emergence of cognitive technologies, the sophistication, features, and capabilities of software vendors are unparalleled.

Hence, the traditional Global 2000 companies are relying on vendor products to power their technology needs and growth aspirations.

When is buying technology a Good Idea?

- When the maturity of the vendor landscape is far superior to what one company can develop.

- The capability area is something that the vendors have created and developed solutions for and hence have inherent capabilities that are beyond any single company.

- The technology is either commodity or context, and standardization is more the goal than enabling a leapfrogging innovation.

Technology Acquisition Option 3 – Outsource

Of course, this does not fit the mold of “Acquisition,” but outsourcing is a perfect way for companies to gain technology capabilities without building or buying. In most cases, companies tend to outsource commodity functions or shared services to a BPO (Business Process Outsourcing) specialist for whom the areas are core bread and butter functions/services.

When is Outsourcing a Good Idea?

- The enterprise that is outsourcing the function doesn’t derive a competitive advantage.

- The BPO services provider excels at such services and is an integral part of their core set of capabilities.

- The cost savings and risk avoidance are undeniable.

- By outsourcing certain functions, the enterprise can renew its focus on core operations and technologies.

Technology Acquisition Option 4 – Licensing

Companies can also acquire technologies by way of licensing one or more patents or commercialize technology from a university or a lab. In this context, we are not referring to paying for a vendor software license.

Typically, licensing technology is prevalent in pharma, biotech, consumer products, and manufacturing sectors.

In this mode, companies license (or buy) innovative new technologies that could be either an insurance policy or become the foundation for the next generation of products/platforms.

When is Technology Licensing a Good Idea?

- The technology is a new invention or innovation, and the only source to get access is through licensing.

- The capability does not exist within the firm and could pose a threat to the core revenue streams and product opportunities.

Technology Acquisition Option 5 – Acquisition or Acqui-Hire

More and more large firms are engaging in M&A (Mergers and Acquisitions – mostly the latter) to acquire critical technologies from startups. Such acquisitions allow for not only access to new technology but often top tech talent.

Sometimes, these acquisitions are considered Acqui-hire when the startup has not fully built out the product or validated the product/market fit, and it is pre-revenue or generates non-material revenue streams. The Acqui-Hire is primarily a talent play, and companies are happy to pay top dollar to onboard leading technologists and innovators.

When is Acquisition or Acqui-Hire a Viable Idea?

- The technology is integral to the future success of the enterprise.

- The growth of the company could pose a threat to core revenues and products.

- The firms feel that the addition of such technology or talent could be accretive to their growth aspirations.

For any large firm, there is no universal answer, and it is different strokes for different folks. The decisions about how to acquire and deploy technologies are situation dependent and reliant on the specific case.

However, if a company seldom acquires (or acqui-hires) or doesn’t outsource even one commodity function, it is likely due to politics and culture and not sound rationale and data-driven decision making.

Senior executives of each firm should find a balance between buying, building, licensing, outsourcing, acquiring technologies. A company that can calibrate the technology acquisition equation is going to be eminently successful in this new paradigm of digitalization and cognitive technologies.

Companies have a ton of data on technology acquisitions of the past and the relative ROI. However, in most companies, while the data exists it does not drive the decisions.

are How does your company make decisions regarding buying, building, outsourcing, licensing, and acquiring? Please share your thoughts.